Best App For Buying Crypto Android – Crypto exchanges work in the same way as online trading platforms do, by giving you the tools you need to buy and sell digital currencies and tokens such as Bitcoin, Ethereum, and Dogecoin. When selecting a cryptocurrency exchange, consider variables such as supported assets, fees, payment methods, and security. When compiling this list of the best cryptocurrency exchanges, we took these things into account.

Best Crypto Exchanges of 2023

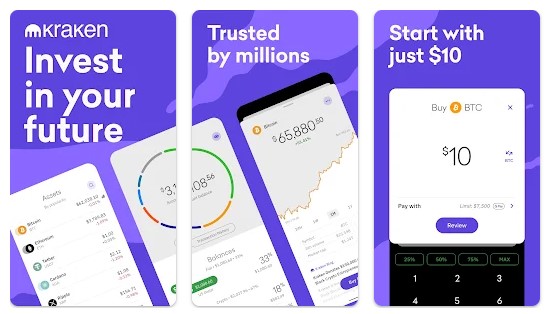

- Best for Low Fees and Best for Experienced Traders: Kraken

- Best for Beginners: Coinbase

- Best Mobile App: Crypto.com

- Best for Security: Gemini

- Best for Altcoins: BitMart Exchange

- Best for Bitcoin: Cash App

- Best Decentralized Exchange: Bisq

1. Kraken

Kraken Pro, Kraken’s professional-grade trading platform, is our pick for the best low-fee exchange since it costs some of the lowest fees in the crypto exchange landscape. It is also our top recommendation for experienced traders, as it enables sophisticated order types and futures and margin trading. Kraken, founded in 2011 and accessible across the majority of the world, is one of the most respected cryptocurrency exchanges worldwide. On its professional-grade trading platform, Kraken Pro, the San Francisco-based exchange allows investors to purchase, sell, and hold more than 185 cryptocurrencies for low costs.

In the early days of the cryptocurrency industry, this feature-rich crypto exchange established itself as the go-to platform for experienced investors, and it has retained its image as a dependable and professional trading venue.

Kraken provides two platforms: its primary trading platform and Kraken Pro, its professional platform. The Pro interface of the exchange offers highly configurable chart analysis capabilities, full visibility into the order books, 13 order types, and rapid execution. In addition to spot trading, Kraken users can also execute margin trading and crypto derivatives trading methods.

While immediate buy fees on Kraken’s primary platform are up to 1.5%, Kraken Pro fees are extremely cheap. Kraken Pro’s tiered cost structure enables high-volume traders to save money on trading expenses. Maker costs begin at 0.16% and taker fees begin at 0.26% for traders with 30-day volumes of less than $50,000 on Kraken Pro. However, maker fees can be as low as 0% and taker fees can be as low as 0.10% (for traders with 30-day rolling volumes greater than $10 million).

2. Coinbase

Coinbase is our recommendation for the best cryptocurrency exchange for beginners since it supports a wide variety of cryptocurrencies, has robust security, and advanced trading features, all on an intuitive platform. Coinbase was formed in 2012 to facilitate the purchase, sale, and storage of Bitcoin. Currently, Coinbase is a publicly traded cryptocurrency exchange with a market capitalization of over $36 billion.

The once San Francisco-based cryptocurrency exchange is now geographically decentralized, without a central office, and accessible in over 100 countries. It distinguishes itself by delivering a user-friendly trading environment, robust security, and a variety of additional tools for advanced traders. Due to its extensive list of supported assets (over 200) and user-friendly interface, Coinbase has become the exchange of choice for many first-time crypto buyers. The software resembles an online banking program, which the majority of consumers are already familiar with, making the transfer to cryptocurrency investing simple.

Coinbase guarantees the digital funds it maintains on behalf of customers and stores U.S. dollar balances in FDIC-insured bank accounts to prevent the loss of user cash in the event of a security breach. Wire transfer and ACH transfer are among the several funding options available for trading accounts.

In addition, Coinbase offers methods for storing cryptocurrency. The initial option for new investors is to store their coins on the Coinbase.com exchange. The second wallet (Coinbase Wallet) is a non-custodial wallet for experienced crypto users. When storing cryptocurrency on Coinbase.com, Coinbase keeps the private keys and stores the funds on the user’s behalf. The user has ultimate control over their funds with Coinbase Wallet because they have the private keys.

Depending on trade volume, Coinbase’s trading fees can be relatively high, ranging from 0% to 0.60 % of the trade volume. Moreover, Coinbase’s customer feedback is relatively negative. Several Trustpilot users, for example, highlight issues with customer service. In addition, there are several reports of sudden account closures that have tarnished the exchange’s reputation.

3. Crypto.com

We chose Crypto.com as the best mobile cryptocurrency exchange app because it provides a comprehensive trading and investment ecosystem for digital assets that is easily accessible from a mobile device. After starting in 2016, Crypto.com has become one of the most prominent global cryptocurrency exchanges. It is currently accessible in 90 countries and supports over 250 coins.

In addition to delivering a huge array of supported assets, Crypto.com offers a vast digital asset ecosystem comprised of its own blockchain, Crypto.org Chain; a native token known as CRO; a crypto visa card; yield-generating crypto products; and more.

However, what strikes out most is the Crypto.com mobile app. While many crypto exchange mobile apps provide a watered-down version of the exchange’s web-based platform, Crypto.com placed a great emphasis on designing an app that offers a vast array of products and features so that customers may take use of this exchange’s ecosystem on the move. Users of the mobile app can purchase, sell, trade, earn interest on, and pay with cryptocurrency.

While Crypto.com provides a vast array of products and functions, customer service is poor. In addition, unless you trade at bigger volumes, you will wind up paying up to 0.075% in trading costs.

4. Gemini

We have selected Gemini as the most secure cryptocurrency exchange due to its rigorous security protocols, insured user cash, and SOC 2-certification. Gemini, launched by Tyler and Cameron Winklevoss in 2014, distinguishes out for its emphasis on security and compliance. The New York-based exchange has insurance for hot wallets to safeguard customer assets in the event of a security compromise. In addition, users must undergo an identity verification procedure to limit the likelihood of fraud.

Gemini also encourages customers to use two-factor authentication to protect their accounts and provides the option to review and approve login devices. Gemini is SOC 2-certified, meaning that independent auditors have validated the company’s security and compliance frameworks.

Gemini offers a professional-grade trading dashboard and supports over 100 digital currencies and tokens. It was designed with advanced traders in mind. Gemini also provides a cryptocurrency reward card and the ability to pay for goods and services with cryptocurrency.

The fee structures for Gemini’s primary platform and active trader platform are distinct. The primary platform imposes fixed fees on smaller trades and a very hefty 1.49 percent on trades above $200. The active trading platform imposes maker-taker fees of up to 0.4%, which decrease as volume increases. These are also relatively expensive. Nonetheless, the rather hefty charge may be a minor amount to pay given Gemini’s exceptionally powerful protection.

5. BitMart Exchange

BitMart is our top pick in the category of best for altcoins since it enables users in 180+ countries to purchase and sell more than 1,000 cryptocurrencies. BitMart, which was founded in 2017, is a global cryptocurrency exchange accessible in over 180 countries. It lets users to purchase, sell, and store more than 1,000 digital currencies and tokens.

BitMart, a company incorporated in the Cayman Islands, has become a leading trading platform for small and mid-cap cryptocurrencies. BitMart has more assets and trading pairings than its market-leading competitors, so investors seeking to add newly-launched or obscure crypto assets to their portfolios can certainly discover them on this exchange.

In addition, BitMart customers can use the Earn feature of the exchange to earn interest on crypto assets held on the exchange. When owning the exchange’s native token, BMX, users can also get trading fee savings.

BitMart has gotten some negative consumer feedback over the years, despite the fact that it offers a great deal to seasoned crypto traders. Several user complaints, for instance, cited withdrawal problems, bad customer service, and a lack of transparency. Nonetheless, there are also some positive reviews.

In addition, a security breach at BitMart in December 2021 led to the loss of $196 million in customer cash. Although BitMart has offered to repay affected users, the attack has severely damaged the exchange’s image.

6. Cash App

Cash App, which was introduced in 2013 by Block, Inc. (previously Square, Inc.), enables users in the United States and the United Kingdom to send, spend, deposit, and invest money. It is essentially a peer-to-peer payments-focused mobile banking application with an investment component. Through Cash App, users can invest in stocks, ETFs, and Bitcoin. Cash App, unlike competitors such as Robinhood and Venmo, allows users to withdraw Bitcoin to third-party wallets, setting it apart from the competition.

Jack Dorsey, the chief executive officer of Cash App, stated early in 2022 that the company had begun rolling out support for the Bitcoin Lightning Network to enable near-instant, nearly costless Bitcoin transfers.

Cash App’s in-app wallet is custodial, meaning the company holds your virtual currency on your behalf. Custodial wallets are considered less secure than non-custodial wallets, despite their convenience. Since you may withdraw Bitcoin from Cash App, you can transfer it to a personal wallet for which you own the private keys. Cash App’s Bitcoin trading costs vary and are only displayed when confirming a purchase or sell transaction. Cash App uses the mid-price and charges a spread fee while trading bitcoin.

7. Bisq

Bisq is an open-source cryptocurrency trading platform that was introduced in 2014 that enables global users to trade a variety of digital currencies and tokens peer-to-peer. Currently, more than 120 digital assets are supported.

This decentralized exchange does not require users to complete a Know Your Customer (KYC) identity verification process, nor does it restrict access to the trading software to users in particular jurisdictions. On Bisq, customers can purchase and sell Bitcoin and other cryptocurrencies using a variety of payment methods, such as bank wire transfers, ACH transfers, and cash deposits.

Although Bisq is popular among early users of cryptocurrencies due to its adherence to many of the principles upon which Bitcoin was founded, such as decentralization, privacy, and sovereignty, the exchange is not particularly user-friendly. The escrow system employed in peer-to-peer trading may be difficult for new users, and the relatively delayed trade execution may discourage both new and active traders. Additionally, the exchange is more focused on smaller trades than centralized worldwide exchanges because trading volumes are lower.

If you wish to begin trading or investing in cryptocurrencies, it is crucial that you select the appropriate exchange for your needs. There is a suitable alternative for you if you desire a big number of digital assets to trade, the lowest feasible costs, or the greatest mobile trading experience. See also : Best Movie Apps to Watch Movies Online